For a start a critical Planning Example:

Let us assume you are a global electronics manufacturer selling Notebooks in two regions: Europe and Asia.

- Both regions sell almost identical products but “compete” with regional targets.

- The company’s overall “profit maximizing strategy” is well communicated.

- Regional targets are somehow contradictionary and the teams do have culturally based different views on how to compete and might see regionally driven targets as more important.

- A global S&OP is not yet implemented, even though regional alignment is already available and global situations are aligned on C-Suite levels and partly also through certain connections on Director levels or even below.

The Market-Situation:

- Your company faces downward-sloping demand curves, while pricing is effected and some production teams are aware of the fact, that this seems to be a function of total quantity produced.

- We further assume demand volumes will have impact on Sales price development for both friendly ‘competing’ Sales Units globally.

Initial Data:

- Europe production: 1 million units

- Asia production: 1.2 million units

- Total production: 2.2 million units

- Global demand curve: P = 1000 – 0.2Q (where P is price and Q is quantity)

- Production cost per unit: $300

What happens next?

- We assume that each sales region decides independently – without knowing of the other’s demand – the quantity of their products to be produced for the coming weeks or months.

- We might assume that the total demand for your products is changing for the next three planning circle; with strong impact on the production facilities and supply partners:

- Europe increases production to 1.2 million units

- Asia maintains 1.2 million units

- Total production: 2.4 million units

- Resulting price: 1000 – 0.2(2.4 million) = $520 per unit

- Profit per unit: $520 – $300 = $220

- Total profit: 2.4 million × $220 = $528 million

To fulfill the overall “profit maximizing strategy” through a global S&OP:

- The global S&OP team becomes a Controlling-Team, used simply to create theoretical planning models like introduced by French economist Antoine Augustin Cournot in 1838 or by John Nash in 1949 to solve for equilibrium in non-cooperative games.

Their proposal could be this one:

- Europe reduces production to 0.9 million units

- Asia reduces production to 1.1 million units

- Total production: 2 million units

- Resulting price: 1000 – 0.2(2 million) = $600 per unit

- Profit per unit: $600 – $300 = $300

- Total profit: 2 million × $300 = $600 million

Takeaways / Learning effect

- Interdependence of decisions: Actions in one market affect outcomes in others, highlighting the need for global coordination.

- Symbiotic collaboration between regions can lead to a more profitable equilibrium, but best decisions are those that create further competive advantages, not directly available in simple data/science and ERP calculations. – It might be a “win-win”, when teams do not become only believers in simple data and not into the cultural essence of selling under certain market circumstances: They will probably find out, that there is much more to gain from each other than being a team build on profit and data.

Annex:

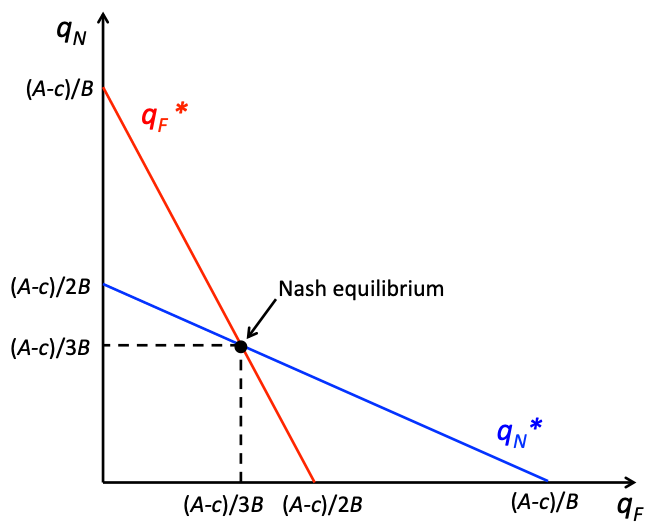

Graphical illustrations for a Nash equilibrium, which is in correspondence of best response functions, which is the same as a crossing of the reaction curves.

Media Attributions

- 18.1.1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license